The Williamson County real estate market continues to adjust in 2025, reflecting a balance between stabilizing prices and increasing inventory. The median sales price, which peaked during the pandemic housing surge, has moderated over the past two years while inventory levels have climbed significantly. Closed sales and new listings indicate a market that is less frenzied but still active, with more choices for buyers and longer timelines for sellers. Below, we dive into the September 2025 data and compare it to the same month last year and two years ago to understand where the market stands today.

1. Year-over-Year Comparison: September 2025 vs. 2024 vs. 2023

| Metric | Sept 2025 | Sept 2024 | Sept 2023 | % Change (’25 vs ’24) | % Change (’25 vs ’23) |

|---|---|---|---|---|---|

| Median Sales Price | $406,700 | $415,670 | $426,752 | -2.2% | -4.7% |

| Closed Sales | 808 | 793 | 791 | +1.9% | +2.1% |

| Sales Dollar Volume (Billion) | 0.38 | 0.374 | 0.388 | +1.6% | -2.1% |

| Months of Inventory | 5.5 | 4.2 | 3.3 | +31% | +67% |

| New Listings | 977 | 1,068 | 1,070 | -8.5% | -8.7% |

| Active Listings | 4,301 | 3,513 | 2,873 | +22% | +50% |

The data shows a clear shift toward a buyer’s market. Inventory levels have risen steadily for three consecutive years, now up more than 67% from 2023, while prices have softened about 5% over the same period. Closed sales have stayed relatively flat, suggesting consistent demand but less urgency.

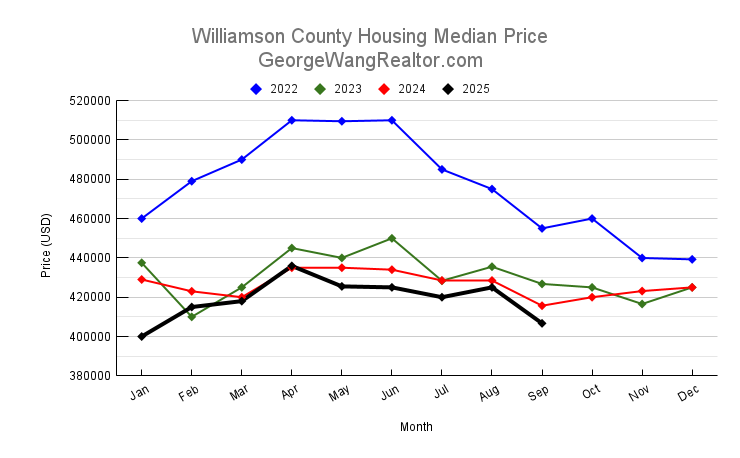

2. Median Sale Price Trend

The median sales price has followed a gentle downward slope since mid-2022. After peaking above $510,000 during the 2022 housing boom, prices declined to the mid-$400Ks in 2023 and early 2024, and have now settled near $406,700 in September 2025.

This gradual correction aligns with broader Central Texas trends—higher interest rates have dampened bidding wars, forcing sellers to adjust expectations. However, the decline has been measured rather than sharp, indicating sustained regional demand driven by population growth and job opportunities in the tech corridor.

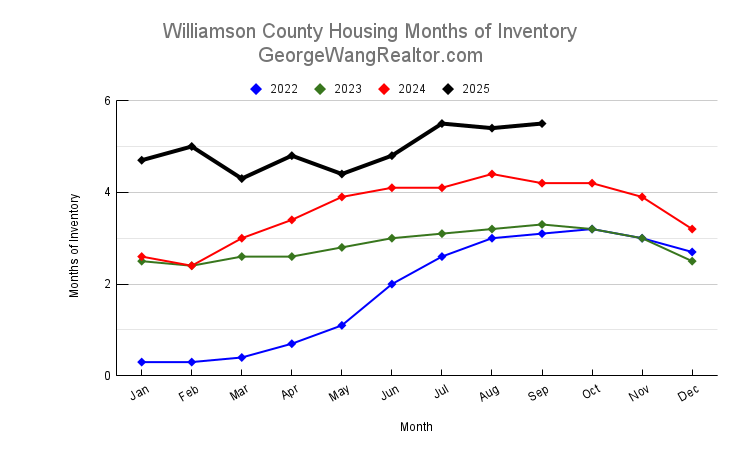

3. Months of Inventory Trend

Inventory growth has been the most pronounced trend in Williamson County. From just 0.3 months in early 2022—a market starved of listings—inventory ballooned to 5.5 months by September 2025.

A balanced market typically sits near 6 months of inventory, suggesting the region has nearly transitioned from an extreme seller’s market to one of equilibrium. Buyers now have more time to compare options and negotiate, while sellers must be more strategic with pricing and concessions.

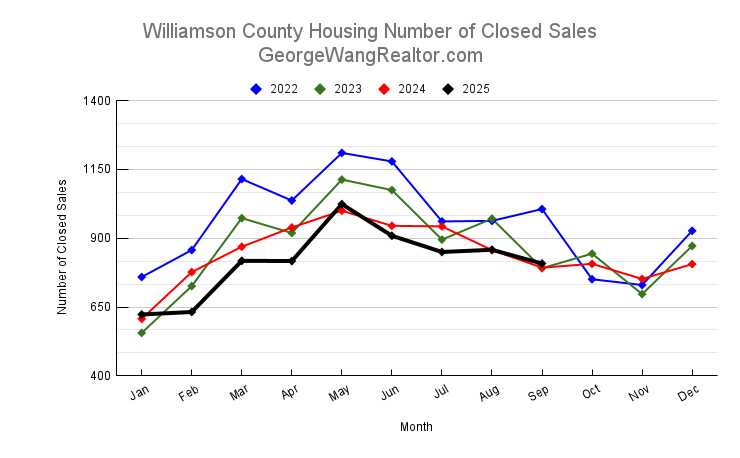

4. Closed Sales Trend

Closed sales have shown remarkable stability over the past three years. September closings were 791 (2023), 793 (2024), and 808 (2025)—a modest upward movement of about 2%. Despite higher borrowing costs, buyer activity remains steady, likely supported by Williamson County’s ongoing economic expansion and relative affordability compared to Travis County.

However, the steady sales volume against rising inventory signals longer listing times and more competition among sellers.

5. New Listings Trend

The number of new listings peaked in spring 2025 (1,841 in May) but has since declined into the fall, reaching 977 in September 2025. That’s about 8–9% fewer than the same time last year.

This seasonal pullback is typical, but the broader pattern shows more cautious seller behavior. Some homeowners may be holding onto low mortgage rates from prior years, while builders continue to contribute to overall inventory with new developments in Georgetown, Hutto, and Leander.

Market Conclusion

The Williamson County housing market of late 2025 reflects a cooling but healthy correction. Median prices have adjusted downward moderately, while inventory levels are at their highest in several years—offering buyers more leverage and choice. Sales remain stable, signaling that underlying demand for homes in this fast-growing region is intact despite market headwinds.

Looking ahead, the county appears poised for a more balanced real estate environment in 2026. Unless mortgage rates drop significantly, prices are likely to hold steady or decline slightly, while ample supply and realistic pricing could keep transaction volumes resilient.

If you have any questions or need any assistance in finding your new home or investment property, please contact me and I will be more than happy to work with you. You can read my client testimonials here.

Please also check out our rebate program which is a win-win situation for my buyer.