The Austin residential real estate market continues to evolve, shaped by economic shifts, rising inventory, and changes in buyer demand. Using data from the Austin Board of Realtors (ABoR), let’s take a closer look at how the market performed in July 2025 compared to the same month last year and two years ago, and what the longer-term trends reveal.

Year-over-Year Comparison

-

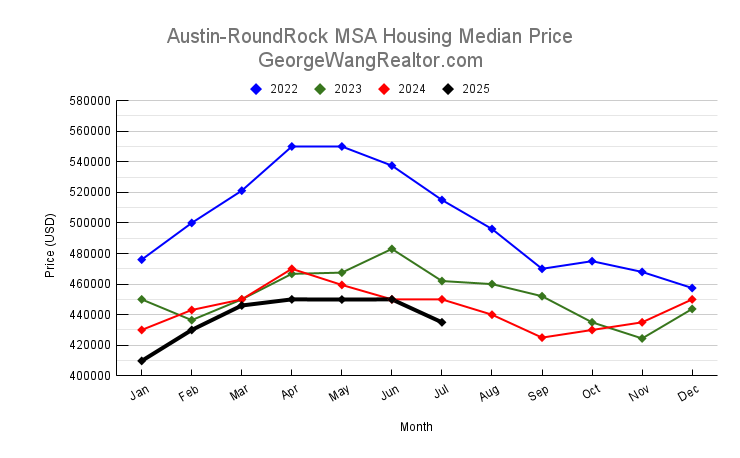

Median Sales Price:

- July 2025: $435,000

- July 2024: $450,000

-

July 2023: $462,000

Prices have declined steadily, down 3.3% year-over-year and 5.8% over two years, signaling ongoing affordability pressures and softer buyer demand.

-

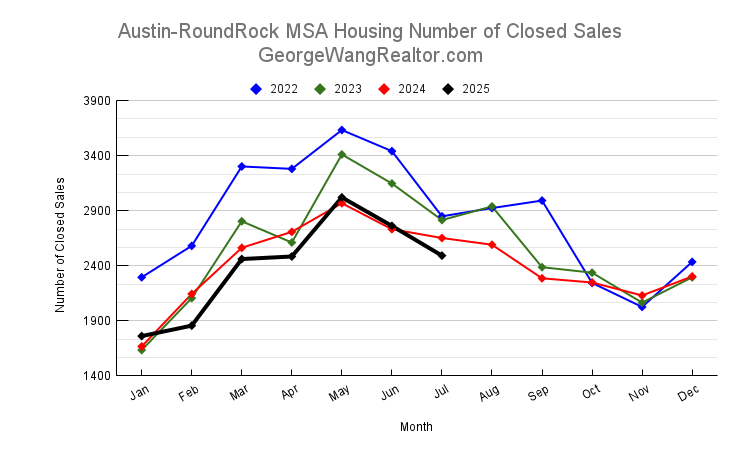

Closed Sales:

- July 2025: 2,492

- July 2024: 2,652

-

July 2023: 2,815

Sales activity continues to cool, with a 6% decline from last year and an 11.5% drop from two years ago, showing fewer buyers are closing deals despite growing inventory.

-

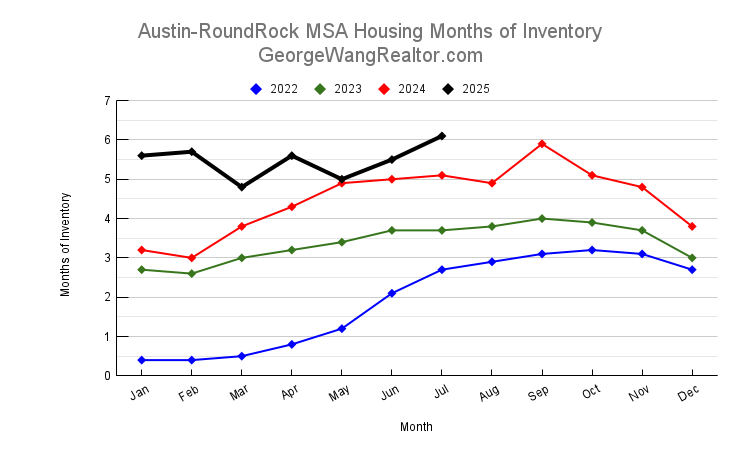

Months of Inventory:

- July 2025: 6.1 months

- July 2024: 5.1 months

-

July 2023: 3.7 months

Inventory has climbed significantly, nearly doubling in two years, moving Austin closer to a buyer’s market after years of being strongly seller-driven.

-

New Listings:

- July 2025: 4,308

- July 2024: 3,812

-

July 2023: 3,884

New listings are up 13% year-over-year and 11% over two years, adding to supply and giving buyers more options.

-

Active Listings:

- July 2025: 15,002

- July 2024: 12,661

-

July 2023: 9,663

Active inventory has surged by 18.5% from last year and more than 55% since 2023, reinforcing the shift toward a market with stronger buyer leverage.

Median Sales Price Trend

The median sales price has steadily trended downward since the peak of Austin’s housing boom in 2022. After topping $550,000 in May 2022, prices have cooled to $435,000 in July 2025. The correction reflects both rising inventory and affordability challenges as high interest rates have curbed buyer budgets. The market has found relative stability in the $430K–$450K range since early 2024, suggesting that further steep declines may be less likely unless economic conditions worsen.

Months of Inventory Trend

Inventory growth is the most defining feature of today’s market. From just 0.4 months in early 2022—a hallmark of extreme seller competition—Austin now sits at 6.1 months of inventory, the highest level in recent years. A balanced market is typically around 5–6 months, so Austin is now leaning toward buyer-friendly conditions, with sellers needing to adjust pricing and expectations to compete.

Closed Sales Trend

Closed sales have followed a downward path, from 3,633 in May 2022 to 2,492 in July 2025. While seasonal patterns still exist, the broader trend is fewer transactions year-over-year. This indicates that many would-be buyers remain on the sidelines, either priced out by interest rates or waiting for further price adjustments.

New Listings Trend

Despite softer demand, sellers continue to bring homes to the market. New listings have risen each year since 2023, with 4,308 in July 2025, compared to 3,812 in July 2024 and 3,884 in July 2023. This steady flow of new supply is keeping pressure on prices and contributing to the buildup in active inventory.

Conclusion

The Austin housing market has clearly shifted from its pandemic-era boom to a more balanced—and increasingly buyer-friendly—environment. Prices are down from their peak, inventory is climbing, and sales volumes are lower, reflecting a recalibration of the market. For buyers, this means more options and negotiating power than at any point in the past several years. For sellers, it requires realistic pricing and patience in a more competitive landscape.

As we move through the rest of 2025, all eyes will remain on interest rates and broader economic conditions. If rates ease, demand could pick up again, but for now, the story in Austin is one of greater balance and a cooling market where buyers finally have the upper hand.

As we move through the rest of 2025, all eyes will remain on interest rates and broader economic conditions. If rates ease, demand could pick up again, but for now, the story in Austin is one of greater balance and a cooling market where buyers finally have the upper hand.

f you have any questions or need any assistance in finding your new home or investment property, please contact me and I will be more than happy to work with you. You can read my client testimonials here.

Please also check out our rebate program which is a win-win situation for my buyer.