The Austin and Central Texas housing market continues to evolve as higher inventory levels, shifting buyer activity, and pricing adjustments reshape the post-pandemic landscape. Using data from the Austin Board of Realtors (ABoR) MLS for 2022–2025, this analysis looks at year-over-year performance, long-term trends, and the market’s overall direction as of the most recent month available: October 2025.

1. Year-Over-Year Comparison (October 2025 vs. October 2024 & October 2023)

Median Sales Price

- October 2025: $439,000

- October 2024: $430,000 → +2.1% YoY increase

- October 2023: $435,000 → +0.9% higher than 2023

After two years of price softening, October 2025 marks a modest rebound, showing stabilization in home values despite elevated inventory.

Closed Sales

- 2025: 2,238

- 2024: 2,248 → Virtually unchanged YoY

- 2023: 2,337 → –4.2% vs. two years ago

Buyer activity remains noticeably lower than pre-2024 levels, reflecting affordability pressures and cautious consumer sentiment.

Months of Inventory

- 2025: 5.3 months

- 2024: 5.1 months

- 2023: 3.9 months

Inventory has continued to climb steadily for two years, pushing the market closer to a balanced state after years of extreme seller dominance.

New Listings

- 2025: 3,607

- 2024: 3,333 → +8.2% YoY increase

- 2023: 3,202 → +12.6% vs. two years ago

More property owners are listing their homes compared to both previous years, giving buyers significantly more choices.

Active Listings

- 2025: 13,277

- 2024: 11,599

- 2023: 9,942

Over two years, active listings have jumped by more than 33%, dramatically expanding available housing supply.

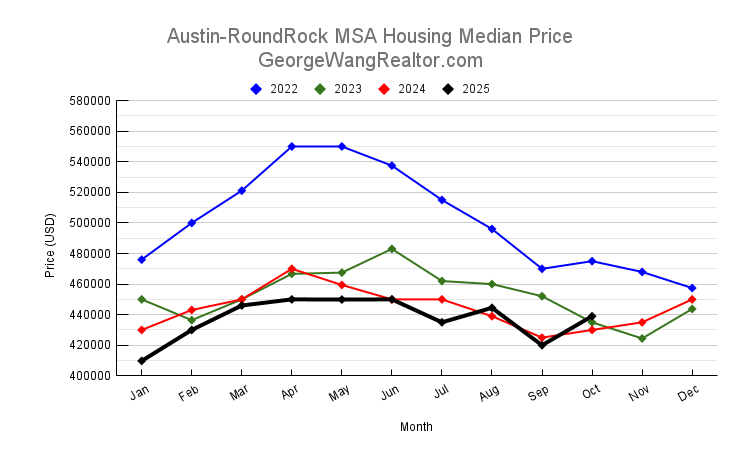

2. Median Sale Price Trend (2022–2025)

Across the four-year span, Austin’s median home price shows four distinct phases:

- 2022: Prices peaked, with several months above $520K–$550K during the boom.

- 2023: A significant correction occurred; the median fell to the mid-$400Ks.

- 2024: Prices flattened, staying close to $430K–$470K.

- 2025: Prices dipped further early in the year (January low: $409,765), then stabilized around $439K–$450K.

Overall, the region has settled into a more sustainable pricing pattern—roughly 15–20% below the 2022 peak—but has shown mild upward movement in late 2025.

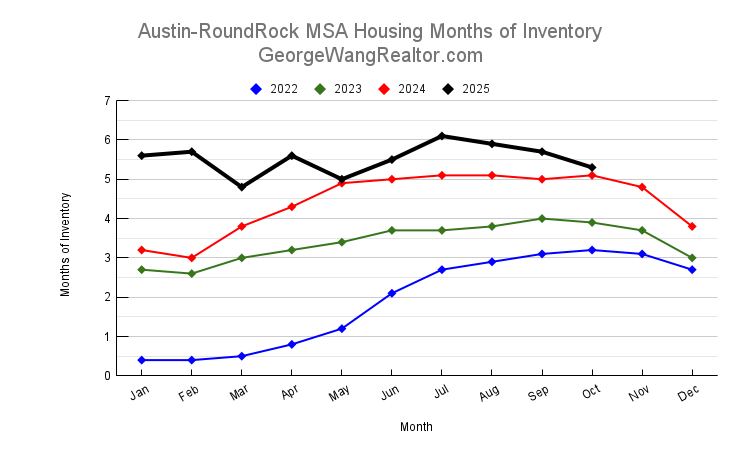

3. Months of Inventory Trend

Inventory is one of the most telling indicators of market balance:

- 2022: Extremely low, often below 1 month early in the year—a heavily constrained seller’s market.

- 2023: Inventory climbed steadily, ending around 3.7 months.

- 2024: Surpassed 5 months in mid-year, indicating a shift toward buyer leverage.

- 2025: Reached 6.1 months in July, the highest in four years, then eased slightly to 5.3 months in October.

Higher inventory is now the norm, giving buyers more negotiating power, reducing competition, and moderating prices.

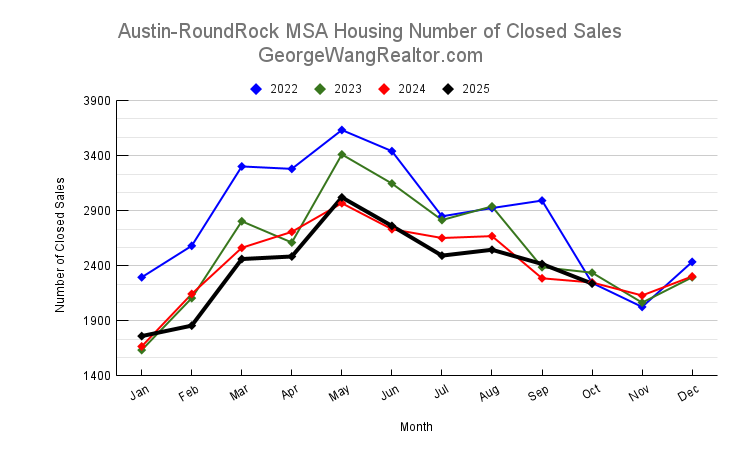

4. Closed Sales Trend

Closed sales have gradually declined from peak activity:

- 2022: Several months with over 3,000–3,600 sales.

- 2023: Activity decreased but remained stable.

- 2024: Sales softened further, particularly in the fall.

- 2025: Continued reduction, with most months below 3,000 sales.

This reduction is partly driven by:

- Higher mortgage rates

- Increased inventory reducing urgency

- Affordability challenges

- Buyer hesitation heading into economic uncertainty

Despite lower sales volume, pricing stability suggests many sellers are adjusting expectations appropriately.

5. New Listings Trend

New listing activity reveals how comfortable homeowners feel entering the market:

- 2022: Surge in listings mid-year as rates rose and sellers tried to exit at peak values.

- 2023: Moderation, with fewer listings than the previous year.

- 2024: Listing activity increased dramatically, especially in spring and summer.

- 2025: New listings remained strong, with several months exceeding 5,000–5,700 new homes hitting the market.

More homeowners are now willing to sell, indicating easing lock-in effects from low pandemic-era mortgage rates.

Conclusion

The Austin and Central Texas housing market in late 2025 reflects a more balanced and sustainable environment than the overheated conditions of 2022. Prices have stabilized, inventory has grown significantly, and buyers have regained negotiating power. While closed sales remain lower than in previous years, strong listing activity and modest price appreciation in recent months suggest growing market confidence. As Central Texas continues to attract new residents and businesses, the region appears positioned for steady—not explosive—growth, signaling a healthier long-term trajectory for both buyers and sellers.

If you have any questions or need any assistance in finding your new home or investment property, please contact me and I will be more than happy to work with you. You can read my client testimonials here.

Please also check out our rebate program which is a win-win situation for my buyer.