The Central Texas housing market has seen dramatic shifts over the past three years. From record-high prices in 2022 to increasing inventory and shifting buyer behavior in 2025, we break down the key trends driving Austin’s real estate landscape. Let’s dive into year-over-year comparisons, price movement, inventory changes, and sales dynamics.

1. Year-over-Year Comparison: May 2025 vs. Prior Years

Here’s a look at May over the past three years:

| Year | Median Price | Closed Sales | Inventory | New Listings |

|---|---|---|---|---|

| 2022 | $550,000 | 3,633 | 1.2 | 5,231 |

| 2023 | $467,500 | 3,411 | 3.4 | 4,545 |

| 2024 | $459,450 | 2,968 | 4.9 | 5,243 |

| 2025 | $449,900 | 3,021 | 5.0 | 5,716 |

- Prices have dropped by ~18% from May 2022 to May 2025.

- Closed sales rebounded slightly in 2025 after a dip in 2024, but remain below 2022 levels.

- Inventory has increased over 4x since 2022, a massive change that marks a shift from a seller’s to a buyer’s market.

- New listings continue to grow, suggesting seller confidence despite softening prices.

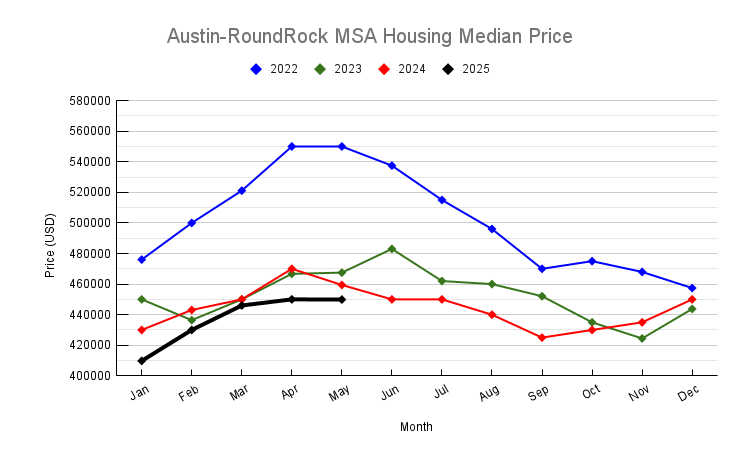

2. Median Sales Price Trend

The median sale price peaked in Spring 2022, hovered near $550,000, then declined through 2023 and 2024:

- 2022 High: $550,000 (April/May)

- 2023 Average: ~$460,000

- 2024-2025 Trend: Gradual softening to ~$450,000 and below in 2025

This reflects market correction after the pandemic-fueled surge, pressured by interest rate hikes and affordability concerns. The price stabilization in early 2025 (~$449,900 in May) may indicate the bottoming out of this trend.

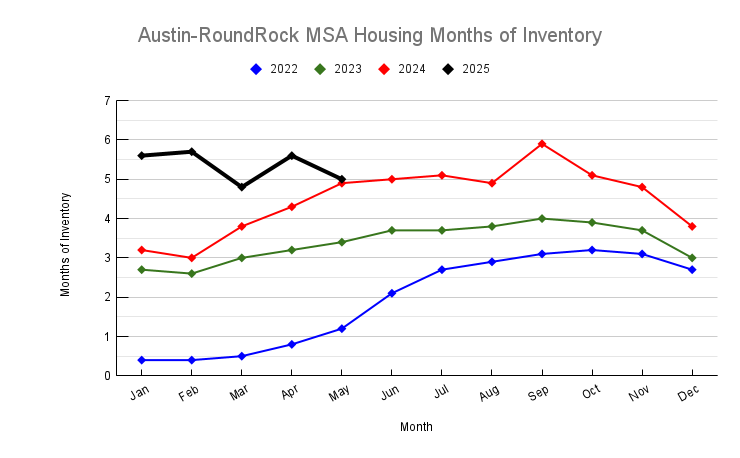

3. Months of Inventory Trend

Inventory levels tell us about market balance:

- 2022: <1.2 months — extreme seller’s market

- 2023: ~3.4 months by May — transitioning

- 2024–2025: Peaked at 5.7 months (Feb 2025) — balanced or leaning buyer’s market

This surge in inventory gives buyers more choices and reduces urgency, slowing price appreciation and increasing days on market.

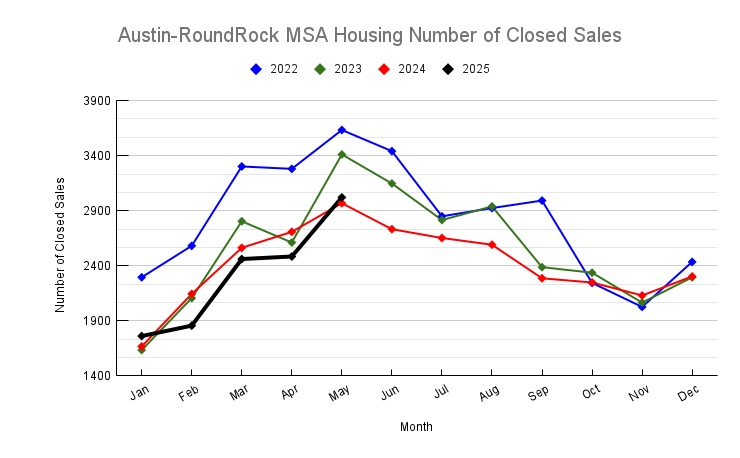

4. Closed Sales Volume Trend

- 2022 Peak: 3,633 homes sold in May

- 2023: Slowed, likely due to buyer hesitation amid rising rates

- 2024: Hit a low in early months, but activity remained muted through May

- 2025: 3,021 homes sold in May — a modest recovery and the strongest spring month since 2022

This suggests renewed buyer interest, likely helped by price stabilization and better supply.

5. New Listings Trend

The number of new listings surged:

- 2022–2023: Ranged from 2,600 to 5,200 monthly

- 2024–2025: Consistently higher; May 2025 saw 5,716 new listings — the highest in 3+ years

This shows that sellers are more active, possibly due to perceived market stabilization, job relocations, or increased confidence.

Conclusion

The Austin real estate market has transitioned from a hyper-competitive, under-supplied seller’s market in 2022 to a more balanced, inventory-rich environment in 2025. Prices have corrected downward and appear to be stabilizing. Meanwhile, buyer activity is beginning to pick up again, supported by a wide selection of homes and potentially more favorable financing options.

Looking ahead, if inventory remains high but demand continues to build slowly, Austin may remain in a moderately buyer-favorable market — a stark contrast to the frenzy of just three years ago. This is a welcome window for buyers who were previously priced out and a wake-up call for sellers to price competitively and prepare for longer days on market.

If you have any questions or need any assistance in finding your new home or investment property, please contact me and I will be more than happy to work with you. You can read my client testimonials here.

Please also check out our rebate program which is a win-win situation for my buyer.