The Austin residential real estate market has experienced significant shifts between 2022 and Feb 2025, reflecting broader economic forces, interest rate adjustments, and changing buyer behaviors. Below is a comprehensive analysis of key market metrics and emerging trends, based on data sourced from the ABOR MLS.

1. Year-over-Year Comparison (As of February 2025)

When comparing February 2025 to the same month in previous years:

- Median Sale Price has decreased by 2.95% from 2024 and 1.47% from 2023, settling at $430,000.

- Number of closed Sales dropped by 13.45% compared to 2024 and 11.88% compared to 2023.

- Sales Dollar Volume also declined, showing an 11.76% decrease from 2024.

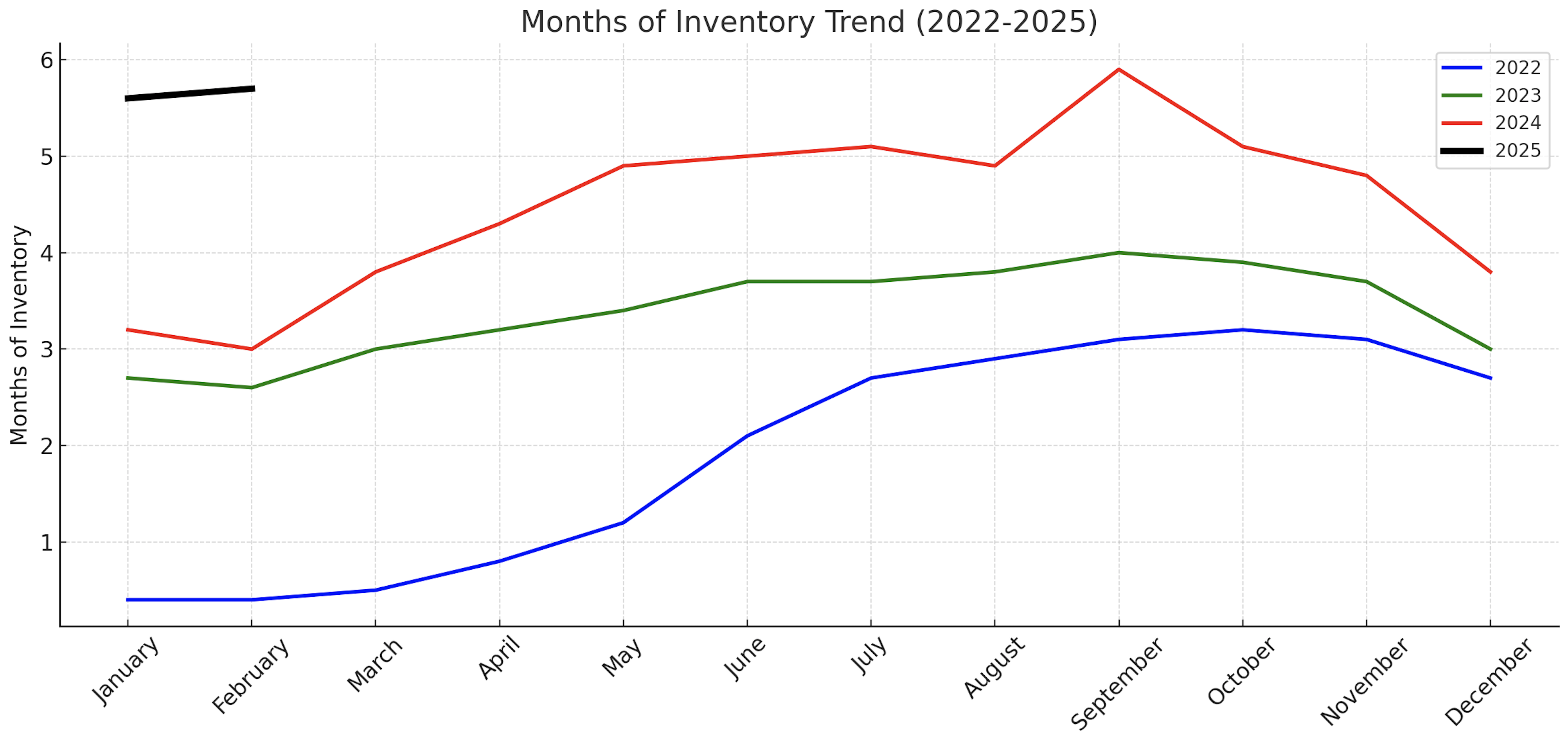

- Months of Inventory surged by nearly 90% compared to last year, indicating a market leaning heavily toward buyers.

- New Listings remained steady year-over-year but were still significantly higher than 2023 levels.

- Pending Sales showed a strong 27.6% increase over 2024, suggesting some resilience in buyer interest.

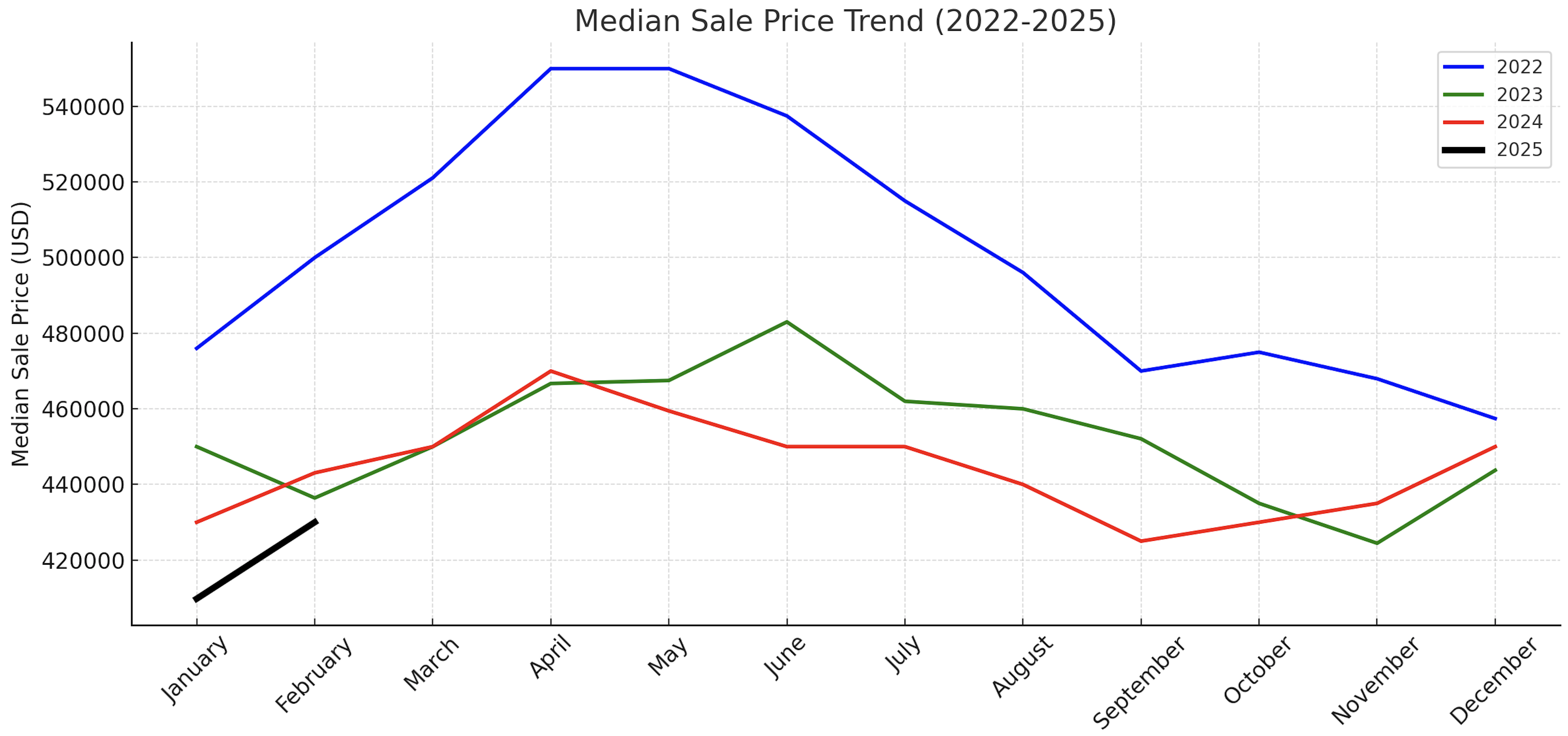

2. Median Sale Price Trend

The median sale price reached its peak in early 2022 at around $550,000 but has been on a slow decline since then. In 2023 and 2024, prices stabilized in the mid-$430,000 range, reflecting the cooling market and more cautious buyer sentiment. Early 2025 data indicates that this decline continues, with prices dipping below $430,000.

3. Months of Inventory Trend

This metric is one of the most telling indicators of market health. In 2022, inventory was extremely tight, staying below 3 months for most of the year. However, by 2024, the inventory level soared to almost 6 months, signaling oversupply. As of February 2025, inventory remains elevated at 5.7 months, giving buyers more power and time to make decisions.

4. New Listings Trend

The number of new listings peaked during the spring and early summer months in all years. While 2023 saw a slight decline compared to 2022, 2024 rebounded with stronger listing volumes. Early 2025 shows new listings remaining robust, with sellers still entering the market despite softer demand.

5. Visual Insights

Charts plotted for median sale price, and months of inventory clearly demonstrate these trends. The sharp rise in inventory and softening of median prices are visually evident, alongside the cyclical nature of new listings.

Conclusion

The Austin residential real estate market is undergoing a shift from a strong seller’s market in 2022 to a more balanced or buyer-friendly environment by early 2025. Buyers now have more choices, more negotiating power, and longer decision-making timelines. Sellers, on the other hand, must remain competitive and strategic in pricing and presentation.

As 2025 progresses, it will be crucial to watch whether demand can rebound and stabilize prices or whether the elevated inventory will continue to apply downward pressure.